Getting ready for Medicare? Here’s your pre-enrollment checklist

By: Bonnie Vengrow

For many people, turning 65 means it’s time to sign up for Medicare. But experts say you should start preparing for enrollment long before then — ideally, about a year or so before your big day.

That’s because Medicare is different from other health insurance you’ve had in the past. There’s an alphabet soup of parts to learn, sign-up windows to remember, late enrollment penalties to avoid and a wide array of coverage options to explore.

“The sooner you start educating yourself about Medicare, the more you’ll know and the more confident you’ll feel about making your choices,” says Christopher Ciano, president of Aetna® Medicare. “The Medicare program is complicated and doesn’t cover 100 percent of your costs, so it’s important to learn about the best options for maximizing your benefits and minimizing your expenses. By giving yourself time to choose the coverage that’s right for you, you won’t be forced into making a quick benefits decision.”

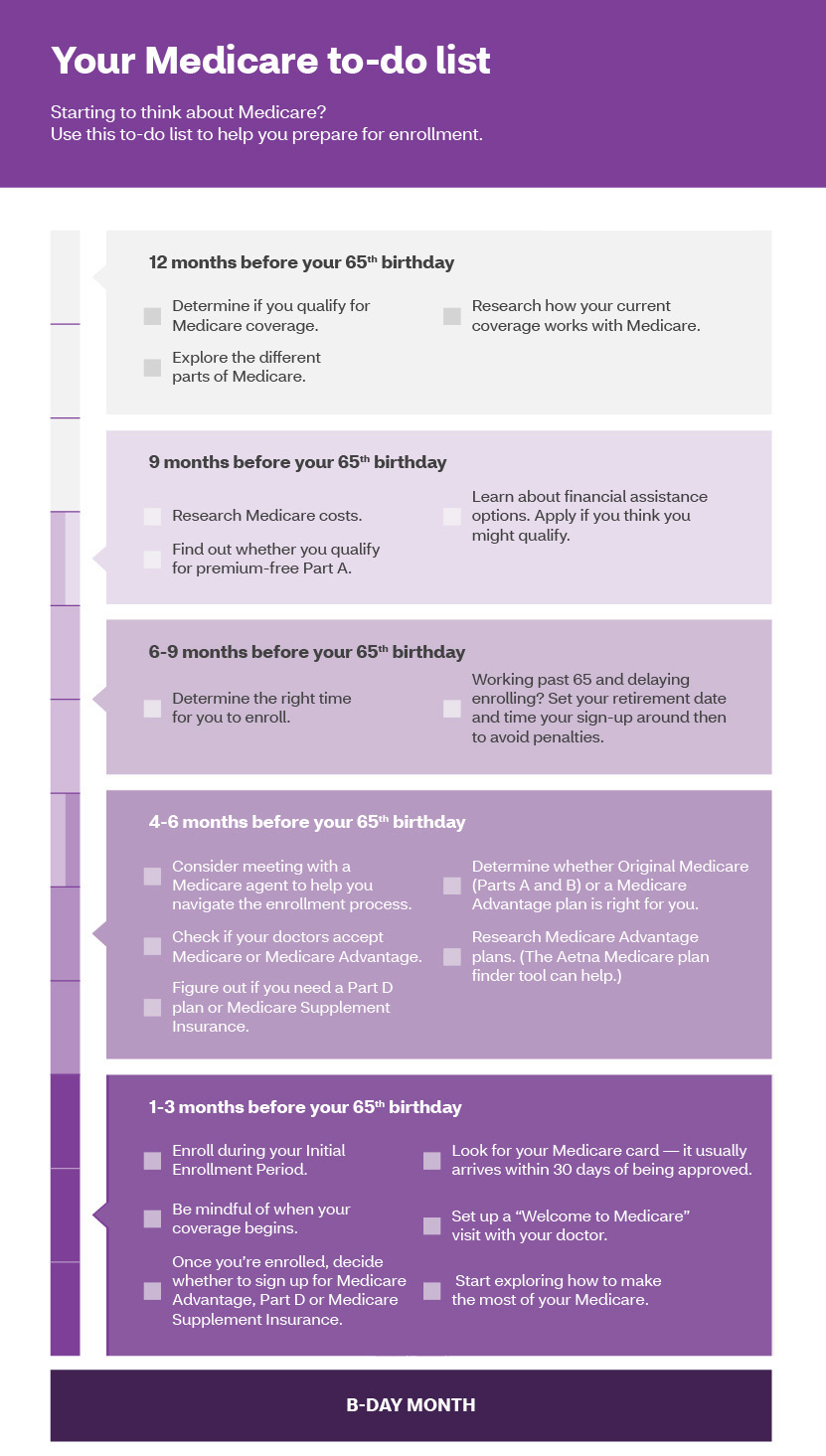

The month-by-month Medicare checklist below helps take the guesswork out of preparing for your enrollment.

12 months before your 65th birthday

At this point, you should have a general idea of what your retirement plan will be. And chances are, it will involve Medicare. “Now is the time to start educating yourself on the basics of the program,” says Ed Bennett, vice president of sales for Aetna Medicare Transition Services.

This includes learning the various parts of Medicare and what each part covers: Part A (hospital insurance), Part B (medical insurance), Part D (prescription drugs), Part C (all-in-one coverage) and Medical Supplement Insurance (Medigap).

If you plan on working past the age of 65, you also need to coordinate your workplace coverage with Medicare. Certain circumstances, such as the size of your company, can impact when you need to enroll. Learn about how to sign up for Medicare on Medicare.gov.

9 months before your 65th birthday

Now that you’re familiar with the coverage options, you’re ready to examine the costs associated with Medicare. As you’ll come to learn, these often depend on your individual circumstances.

The first question you’ll want to answer is whether you qualify for premium-free Part A. If you or your spouse worked and paid Medicare taxes for 10 years or more, you will qualify. Most people do. If you decide to enroll in Part B, you will pay a monthly premium regardless of your work history.

You’ll also want to find out all of the other costs associated with each part of Medicare. This includes monthly premiums, copays, coinsurance and deductibles. Medicare.gov has a breakdown of the costs.

Keep in mind that your income could impact how much you pay for certain parts of Medicare. High earners, for example, pay an extra charge, called an Income-Related Monthly Adjustment Amount (IRMAA), in addition to their monthly premiums for Part B and Part D. (In 2022, that included individuals who earned $91,000 or more or couples who earned $182,000 or more.) If your income falls below a certain amount, you may qualify for financial assistance with Medicare.

6-9 months before your 65th birthday

Determine when it makes sense for you to transition from your existing coverage to Medicare. If you’re planning to continue working after your 65th birthday and delay signing up for certain parts of Medicare, Bennett recommends having a target retirement date in mind. You’ll want to time your enrollment around that date to avoid penalties and gaps in coverage.

4-6 months before your 65th birthday

Bennett recommends talking with your former employer, union or trust who may offer you options. This may include determining whether Original Medicare or Medicare Advantage is right for you and whether you need Part D or Medicare Supplement Insurance.

During this time, you should also check that the doctors, hospitals and pharmacies you like accept Medicare or are part of the Medicare Advantage network you’re considering.

1-3 months before your 65th birthday

Your Initial Enrollment Period (IEP) is underway. This is the seven-month window when you can enroll in Medicare. It runs from three months before the month you turn 65, through your birthday month to three months after the month you turn 65. If your birthday is on the first of the month, your IEP begins four months before you turn 65 and ends 2 months after the month you turn 65.

Set a date on your calendar to enroll and be sure it’s within the seven-month window. Otherwise, you could incur late enrollment penalties.

In addition to your enrollment window, be mindful of when your coverage will begin. The start date depends on when you sign up. For example, if you enroll during the first three months of your IEP, coverage begins the first day of the month you turn 65. But if you enroll the month you turn 65, then your coverage begins one month after you sign up.

Once you’re enrolled in Medicare, you can decide whether to sign up for a Medicare Advantage plan, a Part D plan or Medicare Supplement Insurance.

Look for your red, white and blue Medicare card in the mail. If you have a Medicare Advantage or Part D plan, you’ll receive a separate ID card. Your Evidence of Coverage (EOC), which details what benefits are covered and what your costs will be, will be posted online. You will receive instructions on how to access your EOC in the mail.

With your coverage finalized, you’ll want to set up a “Welcome to Medicare” visit with your doctor. This free, one-time checkup is available within the first 12 months of signing up for Medicare and serves as a baseline for your annual wellness checkups.

By giving yourself plenty of time to prepare for Medicare enrollment, you can choose the coverage that’s right for you and learn how make the most of your benefits.